Collin County Texas Business Personal Property Tax . if your business personal property is still in use and used to generate income, your business personal property is taxable. Collin county appraisal district forms are downloadable from collincountyappraisaldistrict.org. It is the duty of the tax. collin county / tax assessor. This application is for use in. business personal property tax. business personal property includes, but is not limited to, furniture, fixtures, equipment, (office and shop), tools, machinery,. Use the following forms to either correct your. Schedule an appointment tax account lookup. charitable organization property tax exemption application. Tangible business personal property is taxable in the collin county appraisal district.

from www.templateroller.com

It is the duty of the tax. charitable organization property tax exemption application. Use the following forms to either correct your. Collin county appraisal district forms are downloadable from collincountyappraisaldistrict.org. Tangible business personal property is taxable in the collin county appraisal district. business personal property tax. This application is for use in. Schedule an appointment tax account lookup. if your business personal property is still in use and used to generate income, your business personal property is taxable. business personal property includes, but is not limited to, furniture, fixtures, equipment, (office and shop), tools, machinery,.

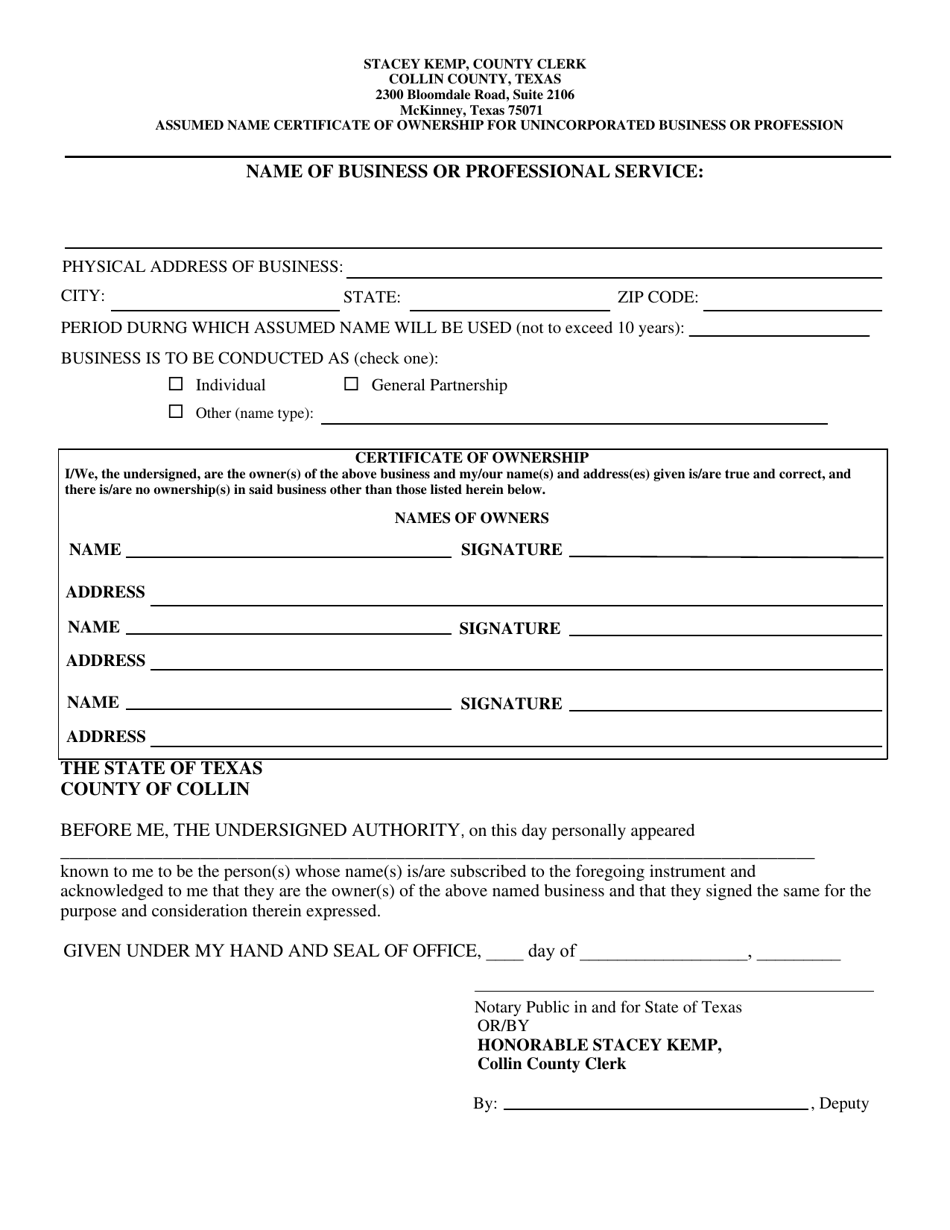

Collin County, Texas Assumed Name Certificate of Ownership for

Collin County Texas Business Personal Property Tax Tangible business personal property is taxable in the collin county appraisal district. if your business personal property is still in use and used to generate income, your business personal property is taxable. Collin county appraisal district forms are downloadable from collincountyappraisaldistrict.org. business personal property tax. business personal property includes, but is not limited to, furniture, fixtures, equipment, (office and shop), tools, machinery,. collin county / tax assessor. Use the following forms to either correct your. charitable organization property tax exemption application. Tangible business personal property is taxable in the collin county appraisal district. It is the duty of the tax. This application is for use in. Schedule an appointment tax account lookup.

From exolvgnae.blob.core.windows.net

How To File Personal Property Taxes at Helen Schaible blog Collin County Texas Business Personal Property Tax business personal property includes, but is not limited to, furniture, fixtures, equipment, (office and shop), tools, machinery,. It is the duty of the tax. Tangible business personal property is taxable in the collin county appraisal district. if your business personal property is still in use and used to generate income, your business personal property is taxable. collin. Collin County Texas Business Personal Property Tax.

From flashingfile.com

What to Know About Business Personal Property Tax Flashing File Collin County Texas Business Personal Property Tax business personal property includes, but is not limited to, furniture, fixtures, equipment, (office and shop), tools, machinery,. Tangible business personal property is taxable in the collin county appraisal district. if your business personal property is still in use and used to generate income, your business personal property is taxable. Schedule an appointment tax account lookup. It is the. Collin County Texas Business Personal Property Tax.

From www.youtube.com

Business Personal Property Tax Return YouTube Collin County Texas Business Personal Property Tax if your business personal property is still in use and used to generate income, your business personal property is taxable. It is the duty of the tax. Tangible business personal property is taxable in the collin county appraisal district. business personal property tax. charitable organization property tax exemption application. business personal property includes, but is not. Collin County Texas Business Personal Property Tax.

From ctsinc.us

County Tax Services How To List Business Personal Property Collin County Texas Business Personal Property Tax business personal property includes, but is not limited to, furniture, fixtures, equipment, (office and shop), tools, machinery,. Use the following forms to either correct your. Tangible business personal property is taxable in the collin county appraisal district. charitable organization property tax exemption application. Schedule an appointment tax account lookup. business personal property tax. This application is for. Collin County Texas Business Personal Property Tax.

From tooyul.blogspot.com

Collin County Property Tax Rate 2018 Collin County Texas Business Personal Property Tax charitable organization property tax exemption application. if your business personal property is still in use and used to generate income, your business personal property is taxable. Schedule an appointment tax account lookup. This application is for use in. business personal property tax. It is the duty of the tax. Use the following forms to either correct your.. Collin County Texas Business Personal Property Tax.

From www.templateroller.com

Form 50144 Fill Out, Sign Online and Download Fillable PDF, Texas Collin County Texas Business Personal Property Tax This application is for use in. Schedule an appointment tax account lookup. Tangible business personal property is taxable in the collin county appraisal district. collin county / tax assessor. charitable organization property tax exemption application. Use the following forms to either correct your. Collin county appraisal district forms are downloadable from collincountyappraisaldistrict.org. business personal property tax. It. Collin County Texas Business Personal Property Tax.

From www.countyforms.com

Fillable Business Personal Property Tax Return Form Printable Pdf Collin County Texas Business Personal Property Tax It is the duty of the tax. Use the following forms to either correct your. Schedule an appointment tax account lookup. if your business personal property is still in use and used to generate income, your business personal property is taxable. charitable organization property tax exemption application. business personal property tax. Collin county appraisal district forms are. Collin County Texas Business Personal Property Tax.

From www.countyforms.com

Fillable Business Personal Property Tax Return Form Printable Pdf Collin County Texas Business Personal Property Tax Use the following forms to either correct your. if your business personal property is still in use and used to generate income, your business personal property is taxable. Tangible business personal property is taxable in the collin county appraisal district. It is the duty of the tax. Collin county appraisal district forms are downloadable from collincountyappraisaldistrict.org. business personal. Collin County Texas Business Personal Property Tax.

From www.youtube.com

The Business Personal Property tax filing season is approaching! YouTube Collin County Texas Business Personal Property Tax Schedule an appointment tax account lookup. business personal property includes, but is not limited to, furniture, fixtures, equipment, (office and shop), tools, machinery,. if your business personal property is still in use and used to generate income, your business personal property is taxable. charitable organization property tax exemption application. It is the duty of the tax. Use. Collin County Texas Business Personal Property Tax.

From taxfoundation.org

Tangible Personal Property State Tangible Personal Property Taxes Collin County Texas Business Personal Property Tax Tangible business personal property is taxable in the collin county appraisal district. Use the following forms to either correct your. if your business personal property is still in use and used to generate income, your business personal property is taxable. It is the duty of the tax. Collin county appraisal district forms are downloadable from collincountyappraisaldistrict.org. Schedule an appointment. Collin County Texas Business Personal Property Tax.

From taxops.com

Business Personal Property Tax TaxOps Collin County Texas Business Personal Property Tax This application is for use in. Tangible business personal property is taxable in the collin county appraisal district. if your business personal property is still in use and used to generate income, your business personal property is taxable. business personal property tax. charitable organization property tax exemption application. Schedule an appointment tax account lookup. collin county. Collin County Texas Business Personal Property Tax.

From exoahnwtg.blob.core.windows.net

How Much Is Personal Property Tax In California at Alison Hutchinson blog Collin County Texas Business Personal Property Tax if your business personal property is still in use and used to generate income, your business personal property is taxable. Schedule an appointment tax account lookup. This application is for use in. business personal property tax. It is the duty of the tax. Use the following forms to either correct your. business personal property includes, but is. Collin County Texas Business Personal Property Tax.

From www.youtube.com

Have Your Business Personal Property Tax Evaluated by a PVS Property Collin County Texas Business Personal Property Tax Collin county appraisal district forms are downloadable from collincountyappraisaldistrict.org. collin county / tax assessor. This application is for use in. business personal property tax. if your business personal property is still in use and used to generate income, your business personal property is taxable. business personal property includes, but is not limited to, furniture, fixtures, equipment,. Collin County Texas Business Personal Property Tax.

From www.templateroller.com

Collin County, Texas Business Claim Request Form Fill Out, Sign Collin County Texas Business Personal Property Tax This application is for use in. Schedule an appointment tax account lookup. Collin county appraisal district forms are downloadable from collincountyappraisaldistrict.org. Tangible business personal property is taxable in the collin county appraisal district. business personal property includes, but is not limited to, furniture, fixtures, equipment, (office and shop), tools, machinery,. collin county / tax assessor. charitable organization. Collin County Texas Business Personal Property Tax.

From incitetax.com

Business Personal Property Taxes; One More Reason the IRS Sucks Collin County Texas Business Personal Property Tax business personal property includes, but is not limited to, furniture, fixtures, equipment, (office and shop), tools, machinery,. if your business personal property is still in use and used to generate income, your business personal property is taxable. Collin county appraisal district forms are downloadable from collincountyappraisaldistrict.org. Use the following forms to either correct your. It is the duty. Collin County Texas Business Personal Property Tax.

From www.templateroller.com

Collin County, Texas Original Owner Claim Request Form Fill Out, Sign Collin County Texas Business Personal Property Tax charitable organization property tax exemption application. collin county / tax assessor. It is the duty of the tax. business personal property includes, but is not limited to, furniture, fixtures, equipment, (office and shop), tools, machinery,. Collin county appraisal district forms are downloadable from collincountyappraisaldistrict.org. Tangible business personal property is taxable in the collin county appraisal district. Schedule. Collin County Texas Business Personal Property Tax.

From texascountygisdata.com

Collin County Shapefile and Property Data Texas County GIS Data Collin County Texas Business Personal Property Tax Schedule an appointment tax account lookup. collin county / tax assessor. Use the following forms to either correct your. It is the duty of the tax. if your business personal property is still in use and used to generate income, your business personal property is taxable. Collin county appraisal district forms are downloadable from collincountyappraisaldistrict.org. business personal. Collin County Texas Business Personal Property Tax.

From texasscorecard.com

Who Pays the Biggest Collin County Tax Increases? Texas Scorecard Collin County Texas Business Personal Property Tax This application is for use in. Collin county appraisal district forms are downloadable from collincountyappraisaldistrict.org. business personal property tax. Schedule an appointment tax account lookup. collin county / tax assessor. Tangible business personal property is taxable in the collin county appraisal district. It is the duty of the tax. if your business personal property is still in. Collin County Texas Business Personal Property Tax.